Canada Emergency Rent Subsidy

- Posted:

This newly announced subsidy will provide rent relief for qualifying renters and property owners who have experienced a revenue decline. The subsidy will be retroactive to September 27, 2020 and continue through to June 2021 with funding coming directly through the Canada Revenue Agency. To date, the government has provided proposed details for the program through to December 19, 2020.

Eligible Entities

The eligibility criteria for the new rent subsidy will generally align with the Canada Emergency Wage Subsidy (CEWS) program. Eligible applicants include individuals, taxable corporations, partnerships, trusts, non-profit organizations, and registered charities with either a payroll account as of March 15, 2020 or a business number as of September 27, 2020.

Eligible Expenses

Eligible expenses incurred in the normal course of operations will include amounts paid to arms-length parties in relation to real property located in Canada and include (net of any sales tax):

- commercial rent;

- property taxes (including school taxes and municipal taxes);

- property insurance; and

- interest on commercial mortgages (subject to limits) for a qualifying property, less any subleasing revenues.

Eligible expenses will also be limited to those paid under agreements entered into before October 9, 2020 (or a continuation of that agreement). There is currently a motion put forth to include amounts paid within 60 days as eligible expenses, as long as the applicant attests to payment of the amounts due under the agreement.

Expenses for each qualifying period will be capped at $75,000 per location and be subject to an overall cap of $300,000 that is to be shared among affiliated entities.

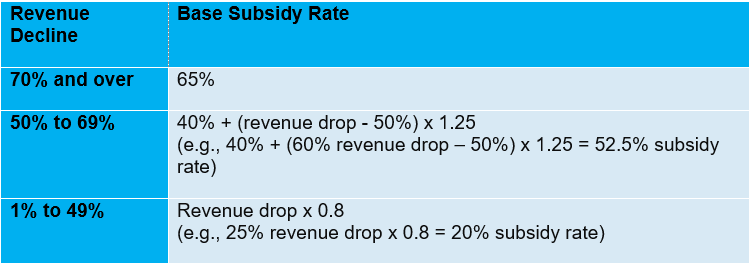

Rent Subsidy Calculation

Qualifying organizations that have suffered a revenue decline will be eligible for a subsidy on qualified expenses. The subsidy rate will be based on revenue declines as follows:

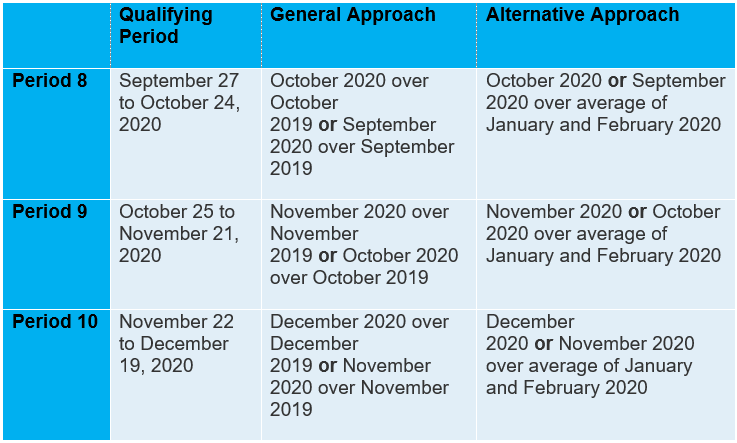

Revenues will be calculated in the same manner as under the existing CEWS program. An organization will be able to choose to calculate its revenue decline by comparing over the same calendar month in the prior year (general approach), or over the average of January 2020 and February 2020 (alternative approach) revenues. Once an organization has chosen to use either the general or alternative approach, they must use that approach for each of the three periods (periods 8, 9 and 10 as listed below). If the organization is also eligible for CEWS, the same approach will apply to both programs.

The table below outlines the CERS reference periods:

Note: The period numbers align with those used for the CEWS, for simplicity. Period 8 of the CEWS program is the first period for which the rent subsidy will be in effect.

Additional Lockdown Support

For organizations that are subject to a lockdown and must shut their doors or significantly limit their activities under a public health order issued under the laws of Canada, a province or territory, a 25% top-up to the CERS has been proposed. The public health order would have to be in effect for at least a week, and would require the organization to completely shut down, or cease some or all of its activities that, in the appropriate pre-pandemic prior reference period, and the shutdown is responsible for at least 25% of revenue decline at that location.

Application Period

All applications for the CERS must be made on or before 180 days after the end of the qualifying period.