Canada Emergency Wage Subsidy

- Posted:

The CEWS program was set to expire in December 2020, however, the program has now been extended to June 2021. The subsidy rate will be fixed at 65%, up to a maximum of $734 per week per eligible employee, through to December 19, 2020 and then decline on a revenue test basis from December 2020 through to June 2021.

Harmonizing the Revenue-Decline Test

The revenue-decline test for the base subsidy and 25% top-up subsidy will be streamlined into one test from September 27, 2020 onward. The top-up subsidy will now be calculated under the same method options as the base subsidy by comparing:

- Monthly revenues, year-over-year, to either the current or previous calendar month, or

- Current monthly revenues with the average of January 2020 and February 2020 revenues

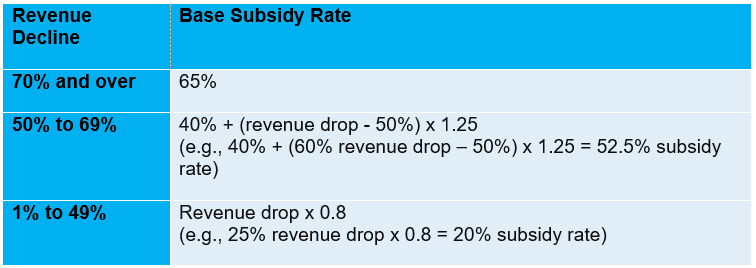

Employers must continue to use the same approach for the prior reference periods that they previously used beginning July 5, 2020. In addition, for claim periods 8 to 10, eligible employers will still be entitled to a top-up wage subsidy that is not lower than the rate calculated under the previous three-month revenue-decline test. As a result of this change, the revised subsidy rate will be based on revenue declines as follows:

Note that these rates are aligned with the rates under the new CERS program.

Extended Application Period

The previous deadline to apply for the CEWS was no later than January 31, 2021. As a result of the CEWS extension to June 2021, applications for qualifying periods are now due by the later of January 31, 2021 or 180 days after the end of the qualifying period.

CRA Audit of Applications

CRA has recently began auditing CEWS claims with fairly significant documentation requests and requirements. Applicants are reminded to ensure that all supporting documentation with respect to claims be retained as the claim could be subject to CRA review.

Canada Emergency Business Account

The CEBA has been expanded to allow an additional interest-free loan of up to $20,000 with $10,000 forgiven if repaid by December 31, 2022. This is in addition to the existing $40,000 interest-free loan program already in place. The application deadline has also been extended to December 31, 2020.

W&P is Here to Support You

We are continuing to monitor government announcements closely to provide you with further updates on a timely basis. If you have any questions or concerns, please do not hesitate to contact our office.