Ontario Made Manufacturing Investment Tax Credit (“OMMITC”)

- Posted:

The provincial government continues to support the manufacturing sector with the introduction of a new 10% refundable tax credit. Qualifying expenditures of up to $20 million per year are eligible for a tax credit of up to $2 million.

The $20 million limit is shared among an associated group of corporations and is prorated for short tax years.

Eligible Corporations

- Must be a Canadian Controlled Private Corporations (CCPCs) throughout the tax year.

- Must not be a tax exempt entity.

- Must carry on business in Ontario, through a permanent establishment in Ontario (i.e., a fixed place of business, such as an office, factory, or workshop).

Eligible Time Period

Applies to eligible expenditures available for use after March 22, 2023

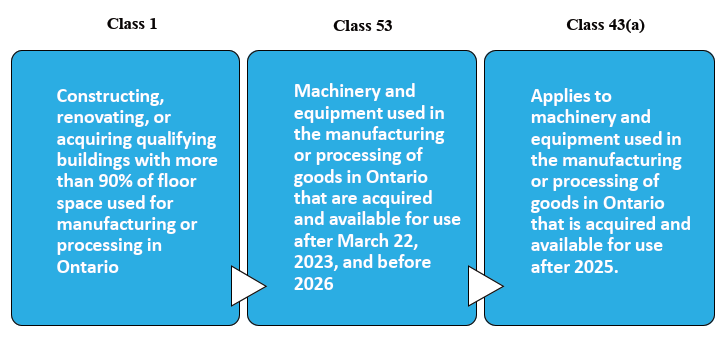

Qualifying Investments/Expenditures and Classes

Example – Eligible Expenditure

A plastics manufacturing corporation in Toronto, Ontario, purchases a new injection moulding machine to enhance its existing manufacturing infrastructure in June 2023. The machine costs $2,000,000 – thus, the corporation would be eligible to receive a $200,000 tax credit (reducing income tax payable or in cash).

W&P is Here to Help

Our team at Williams & Partners is available to provide further information and assistance to corporations regarding the OMMITC. If you have any questions, please do not hesitate to contact us.

Yours very truly,

Williams & Partners